Loading

Get 1998 Instructions 6198

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1998 Instructions 6198 online

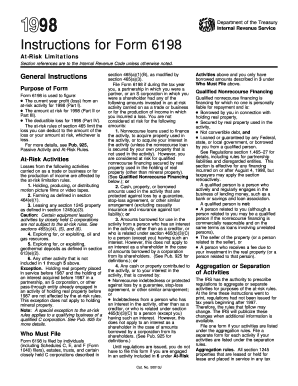

The 1998 Instructions for Form 6198 provide essential guidance on calculating amounts related to at-risk activities for tax purposes. This guide will help users navigate the form online, ensuring they understand each component and can complete it accurately.

Follow the steps to complete the Form 6198 online

- Press the ‘Get Form’ button to access the form and open it in your chosen online editor.

- Read the general instructions carefully to understand the purpose of the form, including the importance of calculating the current year profit or loss from at-risk activities.

- Fill in Part I, which relates to reporting your ordinary income or loss from the at-risk activity without regard to limitations. Ensure to include prior year losses as necessary.

- Move to Part II if applicable, where you can choose to complete a simplified computation of your amount at risk.

- In Part III, if you have not completed it in the prior year, provide detailed calculations for your amount at risk, ensuring to follow the applicable rules and guidelines.

- Review your entries for each part to ensure accuracy, confirming that you include all required figures and any necessary notes.

- Once completed, you can save your changes, download your form for future reference, print it for submission, or share it if needed.

Complete your documents online to stay organized and ensure compliance!

Form 6198 is used to figure at-risk limits. Form 8582 is used to figure passive activity limits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.