Loading

Get Department Of The Treasury Internal Revenue Service 1999 For Calendar Year 1999 Or Short Year

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Department Of The Treasury Internal Revenue Service 1999 For Calendar Year 1999 Or Short Year online

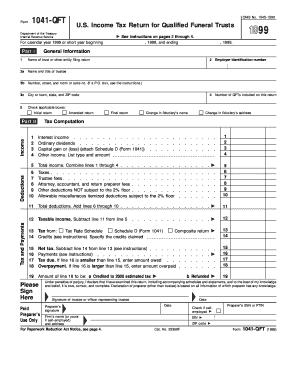

Filling out the Department Of The Treasury Internal Revenue Service Form 1041-QFT for the calendar year 1999 is an essential task for trustees managing qualified funeral trusts. This guide provides clear, step-by-step instructions on how to navigate and complete the form online effectively.

Follow the steps to successfully complete your form online.

- Click the ‘Get Form’ button to access the form and display it in your online editor.

- Begin with Part I, where you will input the name of the trust or entity filing the return. Ensure the name matches the one provided on the Form SS-4 used for obtaining the employer identification number (EIN).

- In the next field, enter the employer identification number (EIN) for the trust. If the trust does not have an EIN, you must apply for one using Form SS-4.

- Provide the complete address of the trust, including room or suite numbers if applicable. If using a P.O. box, include that instead of the street address.

- Select the appropriate box to indicate if this is an initial, amended, or final return. Also mark changes in the fiduciary’s name or address as applicable.

- For Part II, begin entering income data. Input figures for interest income, ordinary dividends, and any capital gains or losses. Ensure you are attaching Schedule D if reporting capital gains.

- Detail any deductions in the provided fields. Specify trustee fees and other deductible expenses, noting which deductions may be subject to the 2% AGI floor.

- Calculate your total income and deductions to determine your taxable income. This is essential for completing the tax computation section.

- Complete any required fields regarding tax credits, net tax due, and indicate your preferred choice for refunds or credits to estimated tax.

- Finish by ensuring all pertinent sections are signed and dated appropriately. Validate that any paid preparer has also completed their required information.

- Finally, save your changes, then download or print the form for submission as directed in the filing instructions.

Take the time to complete your filing online for the Department Of The Treasury Internal Revenue Service Form 1041-QFT to stay compliant and ensure accurate reporting.

Most individual tax returns cover a calendar year, the 12 months from January 1 through December 31. If you do not use a calendar year, your accounting period is a fiscal year. A regular fiscal year is a 12-month period that ends on the last day of any month except December.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.