Loading

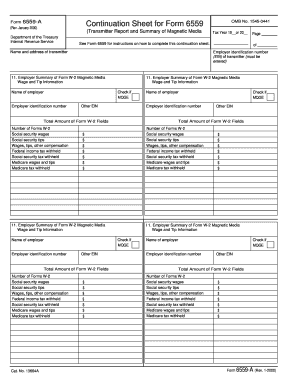

Get 1545-0441 Tax Year 19or 20 Page Of Employer Identification Number (ein) Of Transmitter (must Be

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 1545-0441 Tax Year 19 or 20 Page of Employer Identification Number (EIN) of Transmitter (must be online)

This guide provides a comprehensive overview of how to accurately complete the 1545-0441 form, essential for reporting Employer Identification Numbers for tax years 19 or 20. By following these instructions step-by-step, users can ensure a smooth submission process online.

Follow the steps to fill out the form correctly.

- Press the ‘Get Form’ button to obtain the form and open it in a digital editor.

- Begin by entering the name of the employer in the designated field.

- In the 'Employer Identification Number' section, input the 9-digit EIN assigned by the IRS to the transmitter.

- Indicate the number of Forms W-2 being reported by filling in the corresponding box.

- Complete the sections for 'Social Security Wages', 'Social Security Tips', 'Wages, Tips, Other Compensation', 'Federal Income Tax Withheld', 'Social Security Tax Withheld', 'Medicare Wages and Tips', and 'Medicare Tax Withheld' with the accurate monetary amounts.

- If applicable, check the box for 'MQGE' if you are a Medicare Qualified Government Employee.

- If you used a different employer identification number during the year, enter that in the 'Other EIN' field.

- For reports involving multiple employers, utilize the additional Item 11 fields as outlined on Form 6559-A.

- Review all entries for accuracy and completeness before proceeding.

- Once finished, you can save changes, download the form, print it, or share it as needed.

Complete your document submissions online to ensure compliance and efficiency.

An EIN is an exclusive nine-digit number assigned to your business by the Internal Revenue Service and identifies your business for tax purposes. It's like your Social Security Number, except it's designed for businesses only. It's necessary for paying employees and managing your business taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.