Loading

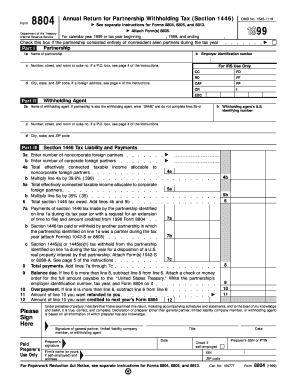

Get 1999 Form 8804. Annual Return For Partnership Withholding Tax (section 1446)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1999 Form 8804. Annual Return for Partnership Withholding Tax (Section 1446) online

Filling out the 1999 Form 8804 is an essential step for partnerships with withholding tax obligations. This guide will provide you with clear, easy-to-follow instructions to ensure that you accurately complete the form online.

Follow the steps to successfully complete your 1999 Form 8804.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, provide the name of the partnership, its employer identification number, and the physical address. Ensure that all information is accurate to avoid processing delays.

- In Part II, enter the name of the withholding agent. If the partnership is also the withholding agent, simply write 'SAME' and skip the remaining fields in this section.

- In Part III, you need to calculate tax liability. First, report the number of noncorporate foreign partners and the number of corporate foreign partners.

- Next, provide the total effectively connected taxable income allocable to noncorporate foreign partners and compute the tax amount by multiplying this figure by 39.6%.

- For corporate foreign partners, report their effectively connected taxable income and calculate the tax owed by using a multiplier of 35%.

- Then, add the total tax amounts from noncorporate and corporate partners to determine the total section 1446 tax owed.

- In lines 7a, 7b, and 7c, report any payments made during the tax year and any withholdings from other partnerships.

- Calculate the total payments made by adding amounts from lines 7a through 7c.

- If the total tax owed is greater than the payments made, calculate the balance due by subtracting total payments from the tax owed.

- If you have overpaid your tax, denote the amount to be refunded or credited toward next year’s Form 8804.

- Finally, ensure that the appropriate signatures are included, and then save, download, print, or share the completed form as necessary.

Take action now and complete your Form 8804 online to ensure compliance with partnership withholding tax obligations.

If the capital gains income is taxable it is not usually subject to withholding. If the capital gains income is taxable, the beneficial owner of the capital gains income is required to report the gains on Form 1040-NR, U.S. Nonresident Alien Income Tax Return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.