Loading

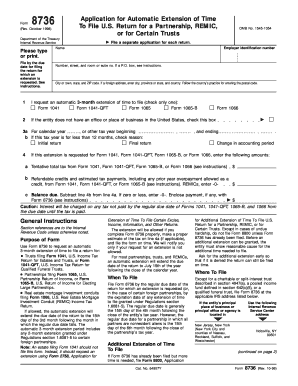

Get Form 8736 (rev. October 1998). Application For Automatic Extension Of Time To File U.s. Return For

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8736 (Rev. October 1998). Application For Automatic Extension Of Time To File U.S. Return For online

This guide provides a comprehensive overview of how to effectively complete the Form 8736, which is used to request an automatic extension for filing U.S. tax returns for specific entities such as partnerships and trusts. Follow these step-by-step instructions to ensure your application is completed accurately.

Follow the steps to fill out the Form 8736 properly.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Fill in the entity's name at the top of the form. Ensure that all information is typed or clearly printed.

- Select the box to indicate which form the extension is being requested for by checking only one of the options provided (Form 1041-QFT, Form 1065-B, Form 1041, or Form 1065).

- If applicable, check the box if the entity does not have an office or place of business in the United States.

- Complete the tax calculation sections: Line 4a requires entering the tentative total tax owed, while line 4b requires listing refundable credits and payments.

- Review all entered information for accuracy before saving changes to the form.

Complete your Form 8736 online today to ensure you secure your tax filing extension!

Form 1041, U.S. Income Tax Return for Estates and Trusts, is used to report yearly income for estates and trusts. It shows the taxpayer's share of income as the beneficiary of an estate or trust.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.