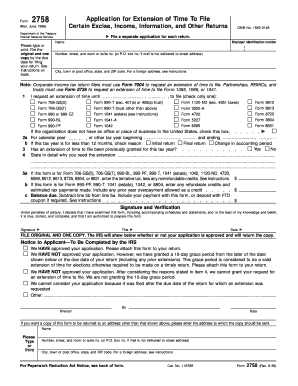

Get Form 2758 (rev. June 1998). Application For Extension Of Time To File Certain Excise, Income

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2758 (Rev. June 1998). Application For Extension Of Time To File Certain Excise, Income online

Filling out Form 2758 allows users to request an extension of time to file specific excise and income tax returns. This guide provides clear instructions to help users understand and complete each section of the form online.

Follow the steps to fill out the form accurately and efficiently.

- Press the 'Get Form' button to access the form and open it for editing.

- Enter your employer identification number in the designated field at the top of the form.

- Provide your name, ensuring it is clearly typed or printed.

- Fill in your address, including the number, street, city, town or post office, state, and ZIP code, ensuring accuracy.

- Select the specific form for which you are requesting an extension by checking the appropriate box in line 1.

- Indicate the tax year for which the extension is needed in line 2a, and check the reason if the tax year is less than 12 months in line 2b.

- Answer question 3 regarding any previous extension granted for this tax year.

- In line 4, clearly describe your reasons for needing the extension, providing sufficient detail.

- Complete line 5a by entering the tentative tax, less nonrefundable credits. Fill in lines 5b and 5c as instructed.

- Sign the form where indicated and provide your title and date of signing.

- Ensure you have a complete understanding of the filing requirements and penalties for late filing.

- Finally, save your changes, and download, print, or share the completed form as needed.

Start completing your Form 2758 online today to ensure you meet your tax filing obligations on time.

You may request up to an additional 6 months to file your U.S. individual income tax return. There are three ways to request an automatic extension of time to file your return. You must request the extension of time to file by the regular due date of your return to avoid the penalty for filing late. Topic No. 304, Extensions of Time to File Your Tax Return - IRS irs.gov https://.irs.gov › taxtopics irs.gov https://.irs.gov › taxtopics

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.