Loading

Get 1999 36b Name(s) Shown On Return Identifying Number Part I 1 2 3a B Current Year Credit (see

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1999 36b Name(s) Shown On Return Identifying Number Part I 1 2 3a B Current Year Credit (See online)

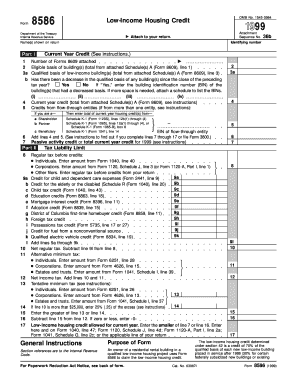

Filling out Form 8586 is essential for claiming the low-income housing credit for the year 1999. This guide provides a clear, step-by-step approach to accurately completing the required fields, ensuring your submission is thorough and meets IRS requirements.

Follow the steps to accurately complete the form.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name(s) shown on the return in the specified section of the form. Ensure that this matches the identification number provided.

- In Part I, complete lines for 'Number of Forms 8609 attached,' ensuring you accurately tally each form you are submitting.

- Fill out the 'Eligible basis of building(s)' by referring to the total from attached Schedule(s) A (Form 8609), line 1.

- For 'Qualified basis of low-income building(s),' use the total from attached Schedule(s) A (Form 8609), line 3.

- Indicate if there has been a decrease in the qualified basis of any building since the end of the previous tax year by selecting 'Yes' or 'No.' If 'Yes,' provide the building identification number (BIN) for any affected properties.

- Complete the 'Current year credit' section by referencing the total from attached Schedule(s) A (Form 8609), following the instructions provided.

- Continue filling out the 'Credits from flow-through entities' by entering the relevant amounts as specified based on your status (shareholder, partner, etc.).

- Review the completed form for accuracy, ensuring all relevant sections are filled in and that all necessary documentation is attached.

- Once completed, you can save changes, download, print, or share the form as needed.

Complete your documents online to ensure timely submission and compliance with IRS regulations.

Look for words on the transcript that are the same, or similar to, the words on the blank return. For example, if you're looking for the amount you entered on Line 4, this amount is your adjusted gross income. On your transcript, it will be listed as "adjusted gross income" under "adjustments to income."

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.