Loading

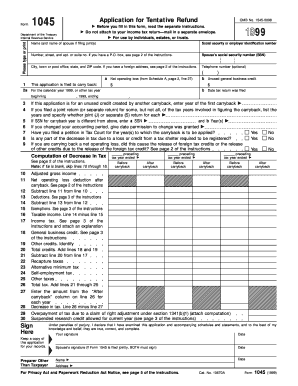

Get Form 1045 Application For Tentative Refund Before You Fill In This Form, Read The Separate

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1045 Application for Tentative Refund

Filling out the Form 1045 Application for Tentative Refund is an important step for individuals, estates, or trusts looking to apply for a tax refund. This guide will provide clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete your Form 1045.

- Click ‘Get Form’ button to obtain the form and open it in your chosen editing tool.

- Begin by filling in your social security or employer identification number at the top of the form. This is necessary for proper identification and processing of your application.

- Provide your address, including number, street, and apartment or suite number. If your address is a P.O. box, refer to the separate instructions for guidance.

- If applicable, enter your spouse’s social security number. This section is relevant for joint applications.

- Indicate the tax year for which you are applying for the refund. Ensure that this is accurately filled out as it determines the applicable tax regulations and limits.

- On the form, you will find specific sections for listing erroneous tax amounts. Carefully follow the instructions to calculate any net operating losses, deductions, and credits accurately. Refer to the detailed instructions as necessary.

- Sign the form in the designated area, as this verifies the information provided. If filing jointly, make sure both you and your spouse sign where indicated.

- Once all sections are completed, you have the option to save changes, download the form, print it for mailing, or share it as needed.

Complete your documents online and ensure you have everything you need for your Form 1045 Application for Tentative Refund.

An individual, estate, or trust files Form 1045 to apply for a quick tax refund resulting from: The carryback of an NOL. The carryback of an unused general business credit. The carryback of a net section 1256 contracts loss.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.