Loading

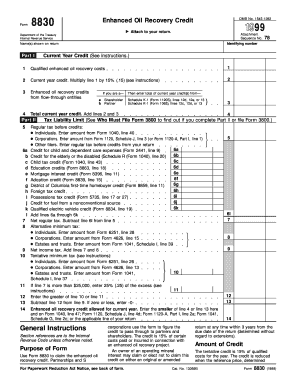

Get Form 8830 Enhanced Oil Recovery Credit Attach To Your Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8830 Enhanced Oil Recovery Credit online

Filling out Form 8830 is essential for claiming the enhanced oil recovery credit, which can provide significant tax benefits for qualifying oil recovery projects. This guide offers straightforward, step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to complete Form 8830 online successfully.

- Press ‘Get Form’ button to access the form and open it in the editor.

- Enter the name(s) shown on your tax return in the designated field.

- Provide your identifying number, which is typically your Social Security number or Employer Identification Number.

- In Part I, line 1, enter the total qualified enhanced oil recovery costs incurred during the tax year.

- Proceed to line 2 and calculate the current year credit by multiplying the amount from line 1 by 15% (0.15). Enter this value.

- Line 3 is for any enhanced oil recovery credits received from flow-through entities. Fill this in if applicable.

- If you are a partner or shareholder, report any shared credits in line 4, as per your ownership arrangement.

- In part II, calculate your net regular tax and list any deductions that apply, filling out lines 5 through 9 accordingly.

- For line 10, if applicable, complete the tentative minimum tax based on additional forms.

- Finally, review all entries for accuracy. Once complete, save your changes, and share or print the form for submission with your tax return.

Start filling out your Form 8830 online now to secure your enhanced oil recovery credit.

Answer: If you lost your refund check, you should initiate a refund trace: Use Where's My Refund, call us at 800-829-1954 and use the automated system, or speak with an agent by calling 800-829-1040 (see telephone assistance for hours of operation).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.