Loading

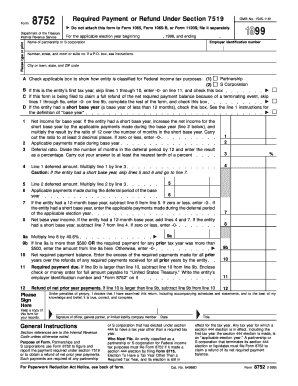

Get 1545-1181 Please Type Or Print Department Of The Treasury For The Applicable Election Year

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 1545-1181 Please Type Or Print Department Of The Treasury For The Applicable Election Year online

This guide provides clear and supportive instructions for users on how to complete the 1545-1181 form, also known as Form 8752, for the applicable election year online. By following these steps, users will efficiently fill out the necessary sections to ensure compliance with tax regulations.

Follow the steps to fill out the form accurately.

- Click the ‘Get Form’ button to acquire the form and display it in the editor.

- Enter the applicable election year at the top of the form, marking the beginning and ending dates.

- Provide the full name of the partnership or S corporation in the designated field.

- Input the employer identification number in the specified section.

- Fill in the address details, including the number, street, room or suite number, city, state, and ZIP code.

- Check the box that reflects how the entity is classified for federal income tax purposes, either as a partnership or an S corporation.

- If applicable, check the box if this is the entity's first tax year or if it is being filed to claim a refund due to a terminating event.

- For line 1, calculate the net income for the base year based on the previous year's financial performance.

- Complete the remaining sections by entering applicable payments and calculating the deferral ratio.

- After calculating required payments and potential refunds, ensure that amounts are correctly entered in their respective lines.

- Once all sections are filled accurately, review your entries for completeness and accuracy.

- Finally, users can save changes to the form, download a copy, print it for submission, or share it as needed.

Start filling out your documents online today to ensure timely compliance.

Changing your tax year To get approval, you must file Form 1128PDF. See the instructions for Form 1128PDF for exceptions. If you qualify for an automatic approval request, a user fee is not required. If you do not qualify for automatic approval, a ruling must be requested and a user fee is required.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.