Loading

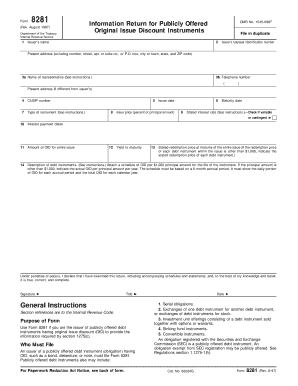

Get 1545-0887 File In Duplicate Issuer's Taxpayer Identification Number 1 Issuer's Name Present Address

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 1545-0887 File In Duplicate Issuer's Taxpayer Identification Number 1 Issuer's Name Present Address online

This guide provides detailed instructions for completing the 1545-0887 form, which is required for issuers of publicly offered debt instruments with original issue discount (OID). By following these steps, users can efficiently prepare and file this important document online.

Follow the steps to complete the form correctly and streamline your filing process.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling out the first section labeled 'Issuer's name.' This is where you will enter the name of the issuer of the debt instrument.

- Next, complete the 'Issuer's taxpayer identification number.' Ensure you provide the correct taxpayer identification number for the issuer.

- Fill in the 'Present address' section with the complete mailing address, including street address, apartment or suite number (if applicable), city or town, state, and ZIP code.

- In the 'Name of representative' field, enter the name of a person who can be contacted regarding this form, along with their telephone number.

- Provide the 'CUSIP number' that is assigned to the debt instruments being reported.

- Enter the type of instrument being filed, choosing from options like fixed rate, variable rate, or contingent payment.

- Complete the fields for 'Issue date' and 'Issue price,' ensuring to express the issue price as a percentage of the principal amount.

- Indicate the 'Maturity date' of the instrument, providing the set date when the instrument will mature.

- For the stated interest rate, enter the annual interest rate applicable to the debt instrument. Check the box if it is a variable or contingent rate.

- Specify the 'Interest payment dates' in this section to indicate when interest payments will be made.

- Fill in the total amount of OID for the entire issue, calculated by subtracting the issue price from the stated redemption price.

- Provide the yield to maturity as a percentage that accurately reflects the instrument's return over its lifetime.

- In the 'Description of debt instruments' section, include a detailed description of the instrument, any terms that may affect payments, and attach any necessary schedules.

- Review all entries to ensure accuracy and completeness before finalizing. Save the document, and options will be available to download, print, or share your completed form.

Complete your 1545-0887 form online to ensure accurate and timely filing.

Ensure that the Employer Identification Number (EIN) is correct. Review the rules in the Business Name Control matrix. If you get a reject because of an EIN/Name Control mismatch, please call the e-Help Desk at 1-866-255-0654 and follow the prompts for assistance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.