Loading

Get Form 6478

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 6478 online

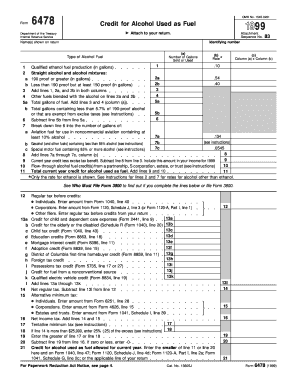

This guide provides detailed instructions for filling out Form 6478, which is used to calculate your credit for alcohol used as fuel. Whether you are a small business owner or an individual, this guide aims to simplify the process of completing the form online.

Follow the steps to fill out Form 6478 efficiently

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your identifying number and the name(s) as they appear on your return in the designated fields.

- In the following section, you will specify the number of gallons of alcohol sold or used. Make sure to separate qualified ethanol fuel production from other types.

- Input the number of gallons for straight alcohol and alcohol mixtures in the subsequent fields. Pay attention to the proof levels of the alcohol when reporting.

- Complete the additional lines regarding blended fuels, ensuring you summarize the total gallons accurately.

- Verify if any of your fuels qualify for exemption from excise taxes as outlined in the instructions, and fill in line 5b accordingly.

- Report any credits received from flow-through entities in line 10, if applicable.

- Once all fields are completed, review your entries for accuracy and completeness before finalizing your form.

- At the end, save your changes, and you will have the option to download, print, or share your completed form as needed.

Complete your Form 6478 online today to ensure you maximize your credits for alcohol used as fuel.

A second generation biofuel producer that is registered with the IRS may be eligible for a tax incentive in the amount of up to $1.01 per gallon of second-generation biofuel that is: sold and used by the purchaser in the purchaser's trade or business to produce a second-generation biofuel mixture; sold and used by the ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.