Loading

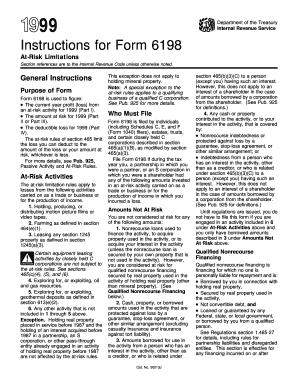

Get 1999 Instructions For Form 6198 At-risk Limitations Section References Are To The Internal Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 1999 Instructions For Form 6198 At-Risk Limitations Section References Are To The Internal Revenue online

This guide provides a clear and detailed overview of how to fill out the 1999 Instructions for Form 6198, focusing on at-risk limitations. Whether you are new to tax forms or seeking to refresh your understanding, this guide is intended to support you in completing the form accurately and efficiently.

Follow the steps to successfully complete Form 6198.

- Obtain the form by clicking the ‘Get Form’ button to access it.

- Begin by reading the general instructions to understand the purpose of the form, which is to calculate the current year profit or loss from at-risk activities.

- Identify your at-risk activities as listed in the instructions, including farming, leasing property, or film production.

- Determine who must file the form — including individuals, estates, trusts, and certain corporations.”

- Visit Part I, where you will report current year income and losses from the at-risk activities. Use your totals from other schedules and forms as necessary.

- Proceed to Part II for a simplified computation of your amount at risk based on your adjusted basis.

- If needed, use Part III for a detailed computation of the amount at risk, ensuring to account for any prior years or additional factors.

- Review all the amounts entered to ensure they accurately reflect the withholding and deductions. Check calculations for previous year losses or income.

- Complete Part IV to identify any deductible losses, ensuring to apply any limitations as indicated.

- After filling out all relevant sections, save your changes, download, print, and retain a copy of the completed form for your records.

Start completing your Form 6198 online today to ensure accurate tax reporting.

Schedule C Loss: At-Risk Rules If everything that has been invested in the company is from your own funds, and therefore any loss by the company comes out of your own pocket (and is not covered for you by someone else), then it is likely that all of the investment is at risk.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.