Loading

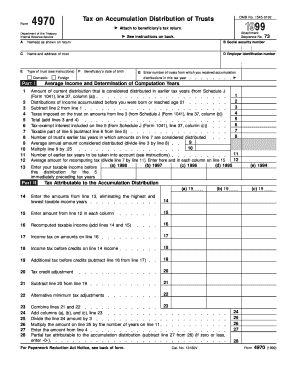

Get 1999 Form 4970. Tax On Accumulation Distribution Of Trusts

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1999 Form 4970. Tax On Accumulation Distribution Of Trusts online

Filling out the 1999 Form 4970, which addresses the tax on accumulation distributions of trusts, can seem complex. This guide aims to provide clear, step-by-step instructions to help you complete this form accurately and efficiently, ensuring you're informed about each section and field involved.

Follow the steps to accurately complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- Complete the header section of the form, which includes your name(s) as shown on your tax return, social security number, and the name and address of the trust. Make sure to include the employer identification number and specify the type of trust as either domestic or foreign.

- In Part I, input the beneficiary’s date of birth. Next, enter the number of trusts from which you received accumulation distributions during the tax year.

- Proceed to the computation section by entering the amount of current distribution that is considered distributed in earlier tax years. Use data from the Schedule J (Form 1041).

- Continue with the required calculations for undistributed net income (UNI) and accumulated income, focusing on the specific lines to ensure accurate figures are reflected.

- In Part II, start by entering calculated amounts to determine the income tax attributable to the accumulation distribution. Pay attention to entering the relevant taxable income for the specified earlier tax years.

- Calculate adjustments needed for tax credits and alternative minimum tax based on the specific guidelines provided for the prior years.

- Complete the final calculations for partial tax attributable to the accumulation distribution and ensure that accurate entries are recorded based on prior fields.

- After completing all sections of the form, review your entries for accuracy. You can now save the changes, download, print, or share the completed form as needed.

Start filling out your 1999 Form 4970 online today to ensure your tax obligations are accurately met.

When trust beneficiaries receive distributions from the trust's principal balance, they don't have to pay taxes on this disbursement. The Internal Revenue Service (IRS) assumes this money was taxed before being placed into the trust. Gains on the trust are taxable as income to the beneficiary or the trust.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.