Loading

Get (for Use By Employers Or Payers)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the (For Use By Employers Or Payers) online

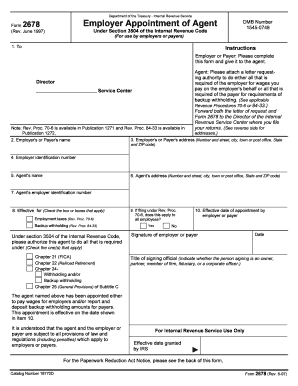

Filling out the Employer Appointment of Agent form (Form 2678) is a critical task for employers or payers wishing to authorize an agent to handle their tax obligations. This guide will provide a clear, step-by-step approach to assist you in completing the form online efficiently.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to obtain the form and open it in your online editor.

- In the first section, enter the name of the person or entity for whom you are completing this form — the employer or payer's name.

- Provide the complete address of the employer or payer, including the street address, city or town, state, and ZIP code.

- Input the employer identification number, a unique identifier for the tax reporting.

- Enter the name of the agent appointed to manage the compliance tasks.

- Fill in the agent's address, providing the necessary details including the street address, city or town, state, and ZIP code.

- Include the agent's employer identification number.

- Indicate whether the appointment is effective for employment taxes, backup withholding, or both by checking the applicable boxes.

- Authorize the agent by checking the corresponding sections that apply, specifically regarding FICA, Railroad Retirement, withholding, or other provisions.

- If applicable, indicate whether this appointment applies to all employees.

- Insert the effective date of the appointment by the employer or payer.

- Ensure the form is signed by the employer or payer, including the date of signing and the title of the signing official, such as owner, partner, or corporate officer.

- After filling in all required fields, review the entries for accuracy before saving your changes, downloading, printing, or sharing the completed form.

Complete your Employer Appointment of Agent form online now for a seamless filing experience.

The PEO agreement indicates which employment tax withholding, reporting and payment the PEO is responsible for on behalf of the client. PEOs pay client employees and employment taxes with funds from the client, and file employment tax returns for the client using the PEO's EIN.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.