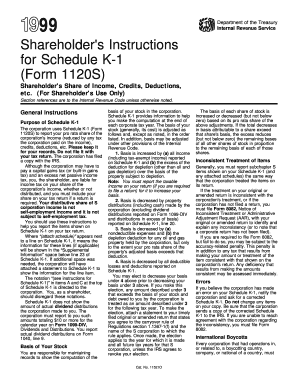

Get 1999 Instructions For 1120s (schedule K-1). Shareholder's Share Of Income, Credits, Deductions, Etc.

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign a form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:Tax, legal, business as well as other electronic documents require a top level of protection and compliance with the legislation. Our templates are updated on a regular basis according to the latest legislative changes. Additionally, with us, all the info you provide in the 1999 Instructions For 1120S (Schedule K-1). Shareholder's Share Of Income, Credits, Deductions, Etc. is well-protected against loss or damage by means of top-notch encryption.

The tips below can help you fill out 1999 Instructions For 1120S (Schedule K-1). Shareholder's Share Of Income, Credits, Deductions, Etc. easily and quickly:

- Open the document in our feature-rich online editing tool by clicking Get form.

- Fill in the required fields which are colored in yellow.

- Click the green arrow with the inscription Next to jump from box to box.

- Use the e-autograph tool to e-sign the document.

- Put the date.

- Read through the whole template to make sure you haven?t skipped anything.

- Click Done and save the resulting form.

Our service enables you to take the entire procedure of executing legal documents online. Due to this, you save hours (if not days or weeks) and get rid of additional costs. From now on, complete 1999 Instructions For 1120S (Schedule K-1). Shareholder's Share Of Income, Credits, Deductions, Etc. from home, workplace, as well as on the move.

Schedule K-1 is an IRS form used by partnerships, S-Corporations, and estates and trusts to declare the income, deductions, and credits that partners, shareholders, and beneficiaries have received in the tax year. Individual taxpayers transfer the financial information on their K-1s to their tax returns.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.