Loading

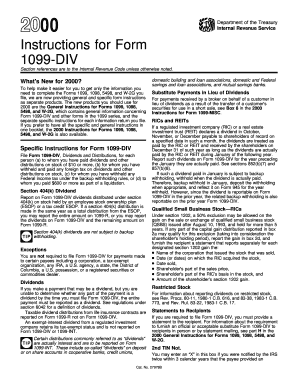

Get 2000 Instructions For 1099div. 2000 Instructions For 1099div, Dividends And Distributions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2000 Instructions For 1099DIV, Dividends And Distributions online

Filling out the 2000 Instructions for 1099-DIV can seem daunting, but with clear guidance, you can complete the form accurately and efficiently. This guide provides a step-by-step approach to help you navigate each section of the form online, ensuring you understand the requirements and details needed for proper submission.

Follow the steps to fill out the 2000 Instructions For 1099DIV online

- Press the ‘Get Form’ button to access the 2000 Instructions For 1099DIV and open it for editing.

- Review the specific instructions provided for Form 1099-DIV, focusing on identifying each person to whom dividends and distributions were paid, ensuring that all payments of $10 or more are recorded.

- Complete Box 1 by entering ordinary dividends, including any reinvested dividends and section 404(k) dividends based on the stockholder's pro rata share.

- Fill out Box 2a with total capital gain distributions, ensuring you include amounts from Boxes 2b, 2c, and 2d.

- For Box 3, enter any nontaxable distributions if determinable, and remember to file Form 5452 if applicable.

- Complete Box 4 by entering any amount subject to backup withholding, ensuring proper tax identification numbers are provided.

- If applicable, enter any foreign tax withheld and paid in Box 6, reporting amounts in U.S. dollars based on the relevant country or U.S. possession.

- Summarize any cash distributions made as part of a liquidation in Box 8, and report noncash distributions in Box 9 with fair market value details.

- After reviewing all entries for accuracy, save your changes, and proceed to download, print, or share the completed form as necessary.

Start filling out your 2000 Instructions For 1099DIV online today to ensure accurate reporting of dividends and distributions.

An exempt-interest dividend is a distribution from a mutual fund that is not subject to federal income tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.