Loading

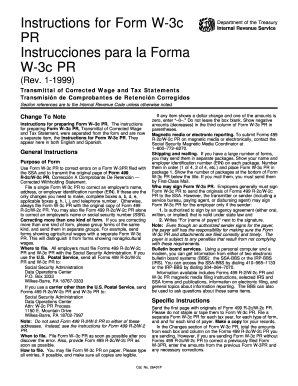

Get Instructions For W-3cpr (rev. January 1999). Transmittal Of Corrected Wage And Tax Statements

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Instructions For W-3CPR (Rev. January 1999). Transmittal Of Corrected Wage And Tax Statements online

This guide provides a detailed overview of how to complete the Instructions for W-3c PR, a form used to transmit corrected wage and tax statements. It offers step-by-step instructions to ensure accuracy and compliance while filling out the form online.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to access the form and open it for editing.

- In Box a, enter the four-digit year of the original Form 499 R-2c/W-2c PR you are correcting.

- In Box b, fill in the employer's name, address, and ZIP code as they appeared on the original Form W-3PR, including suite or unit numbers as necessary.

- In Box c, state the total number of Forms 499 R-2c/W-2c PR included with this submission. If correcting only a previously filed Form W-3PR, enter '0'.

- Box d is optional and can be used for establishing the separate identification numbers for your business's establishments.

- In Box e, provide the correct Employer's Federal EIN, formatted as 00-0000000.

- Mark the appropriate box in Box f to indicate the kind of payer you are.

- In Box g, enter the employer's SSA number or PRU if applicable.

- Boxes h through j should be filled only if the numbers on the original form were incorrect.

- For Boxes 1 through 7, provide the totals from corresponding boxes on Forms 499 R-2c/W-2c PR, completing only those that need correction.

- On any line reflecting a dollar change, if one amount is zero, indicate this as '0' and do not leave it blank.

- Sign and date the form, include your title, and contact information, and provide a fax number or email if available.

- Once all fields are accurately filled, save the changes, and proceed to download, print, or share the form as needed.

Complete your documents online for faster processing.

Where to file Forms W-2c and W-3c only. If you use the U.S. Postal Service, send Forms W-2c and W-3c to: Social Security Administration Data Operations Center P.O. Box 3333 Wilkes-Barre, PA 18767-3333.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.