Loading

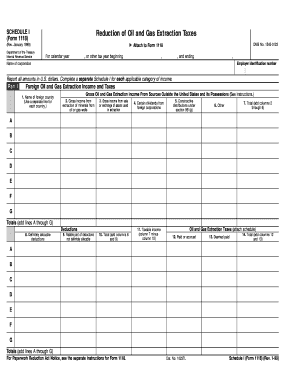

Get Form 1118 (schedule I) (rev. January 1999). Reduction Of Oil And Gas Extraction Taxes

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1118 (Schedule I) (Rev. January 1999). Reduction Of Oil And Gas Extraction Taxes online

Filling out Form 1118 (Schedule I) is essential for corporations seeking to claim a credit for taxes on foreign oil and gas extraction income. This guide provides comprehensive and user-friendly instructions to help you navigate the form accurately and efficiently.

Follow the steps to complete Form 1118 (Schedule I) online

- Click ‘Get Form’ button to obtain the form and open it in the editing environment.

- Fill in the calendar year for which you are reporting, as well as the start and end dates of the relevant tax year.

- Enter the name of the corporation and the employer identification number in the designated fields.

- Report all amounts in U.S. dollars. If applicable, attach a conversion statement for any foreign currency.

- In Part I, list the foreign countries where oil and gas extraction income was earned, using a separate line for each.

- Record gross income from oil and gas extraction in the appropriate fields for each country, including amounts from sales, exchanges, and dividends.

- Add and record totals in Part I to calculate taxable income.

- In Part II, summarize total taxes and enter any carryover or carryback of disallowed credits.

- Calculate the reduction, if any, by following the provided formula and noting it for the corresponding section on Form 1118.

- Review all entries for accuracy before proceeding to save changes, download, print, or share the completed form.

Start competing documents online accurately and efficiently.

Schedule L (Form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate, and other information that satisfies the taxpayer's obligation to notify the IRS of foreign tax redeterminations related to prior years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.