Loading

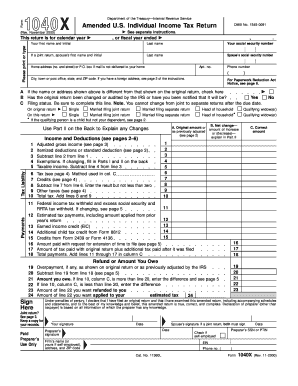

Get Individual Income Tax Return See Separate Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Individual Income Tax Return See Separate Instructions online

This guide provides users with comprehensive instructions for completing the Individual Income Tax Return See Separate Instructions form online. Whether you are amending a previously filed tax return or submitting a new one, this step-by-step guide will help you navigate the process with clarity and confidence.

Follow the steps to successfully complete your tax return online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the personal information section, including your first name, last name, and social security number. If filing jointly, also include your partner's information.

- Enter your home address, phone number, and any other relevant contact information.

- Indicate if the name or address has changed since the original return. If yes, check the appropriate box.

- Select your filing status for the current return. Options include single, married filing jointly, married filing separately, or qualifying widow(er). Ensure this matches the status indicated on your original return, as changes may be restricted.

- Fill in your adjusted gross income, itemized deductions or standard deduction, and any applicable exemptions. Ensure you accurately calculate taxable income.

- Input your income and deductions, making sure to include any credits such as earned income credit or child tax credit.

- Specify total payments made, including federal taxes withheld and estimated tax payments to report any overpayment or amount owed.

- Use Part II on the back of the form to explain any changes you are making compared to your original return. Include line numbers and reasons for each change.

- Review and verify all information filled in the form for accuracy and completeness.

- Once satisfied, you can save your changes, download, print, or share the completed form as needed.

Complete your Individual Income Tax Return today by following these steps online.

You can allow the IRS to discuss your tax return information with a third party by completing the Third Party Designee section of your tax return, often referred to as "Checkbox Authority." This will allow the IRS to discuss the processing of your current tax return, including the status of tax refunds, with the person ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.