Loading

Get Do Not Use This Form For A U

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Do Not Use This Form For A U online

This guide will provide you with comprehensive and clear instructions for filling out the Do Not Use This Form For A U. Whether you're new to this process or have some experience, our step-by-step approach will help ensure accuracy and efficiency.

Follow the steps to effectively complete the form.

- Press the ‘Get Form’ button to access the document and open it in your chosen editor.

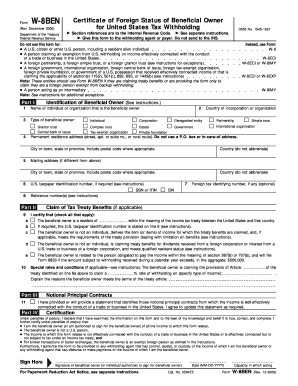

- In Part I, enter the name of the individual or organization that is the beneficial owner in the designated field.

- Select the type of beneficial owner from the options provided, such as individual, corporation, or partnership.

- Fill in the country of incorporation or organization as required.

- Provide the permanent residence address, making sure to include the street address, city or town, state or province, and postal code. Avoid using a P.O. box or in-care-of address.

- Complete the mailing address section if it is different from the permanent residence address.

- If applicable, enter the U.S. taxpayer identification number in the specified field (either SSN or ITIN).

- If available, provide the foreign tax identifying number.

- In Part II, check the certifications that apply to your situation, indicating your eligibility for treaty benefits if applicable.

- Complete the statement detailing specific provisions of tax treaties that apply to you.

- In Part III, if relevant, provide information regarding notional principal contracts and agree to update the statement as required.

- In Part IV, sign and date the form, certifying that all provided information is true and complete. Ensure the signature is from the beneficial owner or an authorized individual.

- Once completed, save your changes, and consider downloading, printing, or sharing the form as needed.

Complete your forms confidently online and ensure all information is submitted correctly.

A purchaser in a bulk sale transaction is also responsible for paying the sales tax due on any tangible personal property purchased or acquired. The tax due may be paid to the seller to be remitted with the seller's final return, or it may be paid directly to the Tax Department.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.