Loading

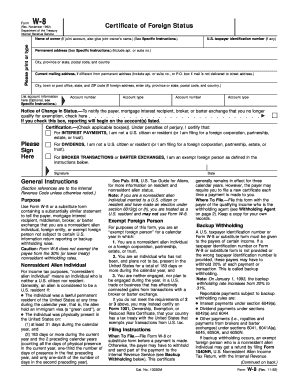

Get Taxpayer Identification Number (if Any)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Taxpayer Identification Number (if Any) online

Filling out the Taxpayer Identification Number (if Any) form online is a crucial step for individuals and entities to ensure compliance with U.S. tax regulations. This guide will walk you through each section of the form, making the process clear and manageable.

Follow the steps to complete your form with ease.

- Click ‘Get Form’ button to obtain the form and open it in your document management system.

- Begin by entering the name of the owner. If it is a joint account, ensure to include the name of the joint owner as well.

- If you have a U.S. taxpayer identification number, enter it in the specified field. If you do not have one, leave this section blank.

- Provide your permanent address, including any apartment or suite number. Make sure to include the city, province or state, postal code, and country.

- If your current mailing address differs from your permanent address, enter it in the designated space, including the relevant details as above.

- You may choose to list account information in this section if applicable, detailing account numbers and types.

- If there is a change in your status affecting your exemption, check the appropriate box to notify the payer, mortgage interest recipient, broker, or barter exchange.

- Read the certification section carefully and check the applicable boxes regarding your status as a U.S. citizen or resident. This is crucial as it impacts tax reporting and withholding.

- Sign the form in the designated area and ensure you date it. This signature confirms the information provided is accurate.

- Finally, review the completed form for any errors. Once satisfied, you may choose to save changes, download, print, or share the form as necessary.

Start filling out your Taxpayer Identification Number form online today to ensure your compliance!

Social Security Number, the most important aspect that stands out is that SSN is a type of TIN. The major difference between Social Security number (SSN) and any other tax id is that this number is primarily used by individuals for filing taxes while a tax ID number like EIN is used by businesses to file their taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.