Loading

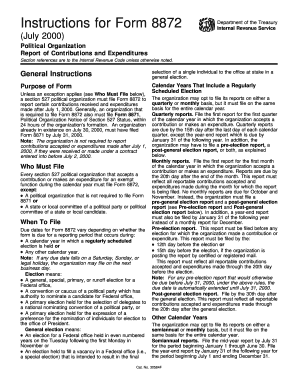

Get Instructions For 8872 (rev. July 2000). Political Organization Report Of Contributions And

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the instructions for 8872 (Rev. July 2000) Political Organization Report of Contributions and Expenditures online

Filling out Form 8872, the Political Organization Report of Contributions and Expenditures, is essential for section 527 political organizations to ensure compliance with reporting requirements. This guide provides clear, step-by-step instructions on how to correctly complete each section of the form online.

Follow the steps to successfully complete Form 8872 online.

- Click the ‘Get Form’ button to access the form digitally and open it for completion.

- Review the purpose of Form 8872. It is intended for section 527 political organizations that have received contributions or made expenditures since July 1, 2000.

- Understand who must file. Every section 527 political organization accepting contributions or making expenditures must file Form 8872, except for specific exemptions.

- Determine when to file. Deadlines vary based on whether a regularly scheduled election occurs and whether the organization opts for quarterly or monthly reporting.

- Fill in the required personal and organizational details, including the organization’s name, Employer Identification Number (EIN), and contact information.

- Indicate the type of report being filed (initial, change of address, amended, or final) by ticking the appropriate box.

- Complete Schedule A if the organization has accepted contributions amounting to $200 or more. List each contributor and relevant details about their contributions.

- Fill out Schedule B for itemized expenditures, providing information on each recipient to whom expenditures exceeding $500 have been made.

- Review all completed sections for accuracy. Ensure all necessary information is filled in to avoid penalties.

- Save your changes, download the completed form, and print or share it as required. Ensure it is submitted to the appropriate IRS location.

Complete your Form 8872 online today to ensure compliance and stay organized.

The penalty is 21 percent of the total amount of contributions and expenditures to which a failure relates.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.