Loading

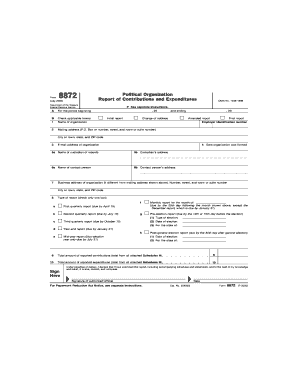

Get Form 8872 Rev. (july 2000). Political Organization Report Of Contributions And Expenditures

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8872 Rev. (July 2000). Political Organization Report Of Contributions And Expenditures online

This guide provides step-by-step instructions on how to accurately fill out the Form 8872 Rev. (July 2000). Political Organization Report Of Contributions And Expenditures online. Follow these instructions to ensure proper reporting of contributions and expenditures.

Follow the steps to complete your report accurately.

- Click ‘Get Form’ button to access the form and open it in the designated editor.

- Begin by filling out section A, which includes the name of the organization, mailing address, and contact information. Ensure that you also indicate the type of report by checking the applicable box.

- In section B, provide the period for which the report is being submitted, including the start and end dates.

- Complete section 8 by selecting the type of report you are filing, such as quarterly or year-end report, ensuring to check only one box.

- Report total contributions in line 9. This should be the sum of contributions detailed in Schedule A, which you will fill out next.

- Proceed to Schedule A, where you will itemize contributions. For each contributor, input their name, address, employer, and amount contributed, including the total amount for that schedule.

- After completing Schedule A, return to Form 8872 to enter the total from Schedule A into line 9.

- Next, complete Schedule B to itemize expenditures, entering the recipient's details and expenditures for this reporting period.

- Once Schedule B is finalized, return to Form 8872 and input the total from Schedule B into line 10.

- Finally, sign the form, affirming that the information is true and accurate. Save your changes, download, print, or share the form as needed to complete your filing.

Complete your Form 8872 online today to ensure timely and accurate reporting.

Failure to File a Return / Late Filing Penalty Any taxpayer who is required to file a return, but fails to do so by the due date. 5% of the tax due, after allowing for timely payments, for every month that the return is late, up to a maximum of 25%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.