Loading

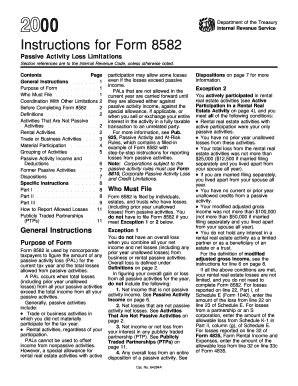

Get 2000 Instructions For 8582. Passive Activity Loss Limitations

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2000 Instructions for 8582. Passive Activity Loss Limitations online

This guide provides step-by-step instructions for filling out the 2000 Instructions for Form 8582, which details passive activity loss limitations. Whether you are a first-time filer or seeking clarification, this guide will assist you in completing the form accurately online.

Follow the steps to easily fill out the form online.

- Press the ‘Get Form’ button to obtain the 2000 Instructions for Form 8582. This will open the document for you to review and fill out.

- Review the purpose of the form, which is used to determine the amount of passive activity loss for the tax year. Make sure to read all general instructions carefully to understand your obligations.

- Identify if you must file this form by determining if you have any passive activity losses. Read the sections under 'Who Must File' to see if any exceptions apply to you.

- Gather all necessary documentation related to your passive activities, including income and losses from trade or business activities, as outlined in the document.

- Complete Part I of the form by entering your total income and losses derived from passive activities. Use the specified worksheets for accurate calculations.

- If applicable, move to Part II for special allowance calculations if you actively participated in rental real estate activities.

- Progress to Part III and determine the total losses allowed. Make sure to follow the instructions for worksheets four, five, and six to accurately report your gains and losses.

- Review your entries for accuracy before saving changes. You can then download, print, or share the completed form as needed.

Complete your documents online today to ensure compliance and efficiency.

A taxpayer's at-risk amounts include: (1) the amount of money and the adjusted basis of property that the taxpayer contributes to the activity, and (2) amounts borrowed with respect to the activity to the extent that the taxpayer is personally liable or has pledged property other than that used in the activity as ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.