Loading

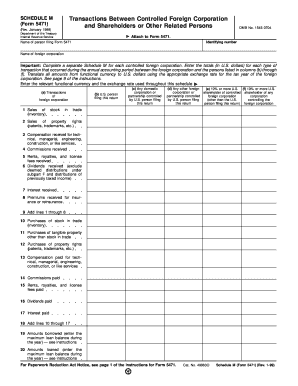

Get Form 5471(schedule M)(rev. January 1999). Transactions Between Controlled Foreign Corporation And

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5471(Schedule M)(Rev. January 1999). Transactions Between Controlled Foreign Corporation And online

This guide provides a step-by-step approach for users to effectively fill out the Form 5471 (Schedule M) for reporting transactions between controlled foreign corporations and shareholders or other related persons. Whether you are new to this process or seeking a clearer understanding, this instructional guide will support you in completing the form accurately.

Follow the steps to accurately complete Form 5471(Schedule M)

- Click the ‘Get Form’ button to access the form and open it in your editing software.

- Begin by entering the identifying number, your name as the person filling out the form, and the name of the foreign corporation. Ensure that you provide accurate details as required.

- Complete a separate Schedule M for each controlled foreign corporation. For each type of transaction during the accounting period, list the totals in U.S. dollars as instructed.

- Start detailing the transactions. In the first column, specify the type of transaction, such as sales of inventory or property rights, and continue entering the necessary data across the respective columns for each related person listed.

- Continue filling out the form by adding totals for transactions listed under lines 1 through 8. This includes various categories such as dividends received, interest received, and any other applicable transactions.

- Review all entries for completeness and correctness. Make necessary adjustments or corrections prior to finalizing the document.

Start filling out your documents online to ensure compliance and accurate reporting.

(A U.S. shareholder is any U.S. person who owns or is deemed to own 10 percent or more of all classes of stock entitled to vote.) A U.S. taxpayer who is a shareholder in a CFC must file Form 5471.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.