Loading

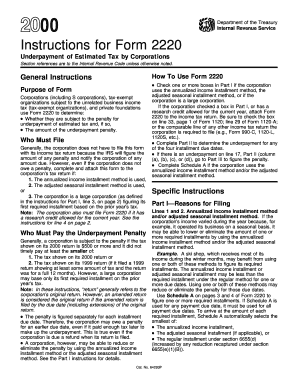

Get 2000 Instructions For 2220. Underpayment Of Estimated Tax By Corporations

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2000 Instructions For 2220. Underpayment Of Estimated Tax By Corporations online

Filing the 2000 Instructions For 2220. Underpayment Of Estimated Tax By Corporations can be an essential process for corporations to determine any underpayment penalties. This guide offers a step-by-step approach to navigating each section of the form online, ensuring users understand the requirements and can complete the form accurately.

Follow the steps to fill out the form effectively.

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- In Part I, check the relevant boxes if the corporation is using the annualized income installment method, adjusted seasonal installment method, or if it qualifies as a large corporation. This determines the necessary calculations.

- If applicable, attach Form 2220 to the income tax return. Remember to check the corresponding box on the appropriate line of Form 1120 or similar returns.

- Complete Part II to calculate the exact underpayment amount for any of the four installment due dates, referencing the specific lines to enter taxes from Form 1120 or relevant returns.

- If underpayment is indicated on line 17 of Part II, proceed to Part III to compute the penalty for the underpayment.

- Complete Schedule A if using the annualized income or adjusted seasonal methods, ensuring all required parts of the schedule are filled out based on your selections in Part I.

- Review all entries for accuracy before finalizing your form. Consider saving your changes, downloading the document, or printing it for records.

Complete your documentation by filing the 2000 Instructions For 2220 online today.

The IRS levies underpayment penalties if you don't withhold or pay enough tax on income received during each quarter. Even if you paid your tax bill in full by the April deadline or are getting a refund, you may still get an underpayment penalty.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.