Loading

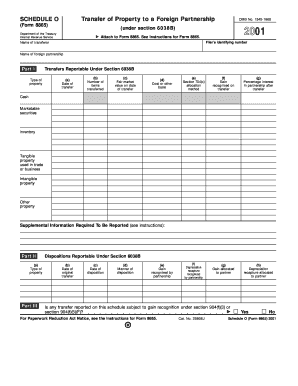

Get 2001 Form 8865 (schedule O). Transfer Of Property To A Foreign Partnership

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2001 Form 8865 (Schedule O). Transfer Of Property To A Foreign Partnership online

Filling out the 2001 Form 8865 (Schedule O) is essential for reporting the transfer of property to a foreign partnership. This guide provides step-by-step instructions to ensure users can complete the form accurately and confidently, enhancing their understanding of the process.

Follow the steps to complete 2001 Form 8865 (Schedule O) accurately.

- Press the ‘Get Form’ button to access the document and open it in the appropriate format.

- Fill in the filer’s identifying number at the top of the form to ensure proper identification and tracking.

- Provide the name of the transferor, which is the individual or entity transferring the property.

- Enter the name of the foreign partnership receiving the property.

- In Part I, specify the type of property being transferred by checking the applicable boxes such as cash, marketable securities, inventory, etc.

- For each item transferred, enter the date of transfer, the number of items transferred, and the fair market value on the date of transfer in the corresponding fields.

- Document the cost or other basis of the property, ensuring accuracy according to the records of the transferor.

- Indicate the Section 704(c) allocation method if applicable, to clarify how income or loss will be allocated among partners.

- Record any gain recognized on the transfer, which is crucial for tax reporting purposes.

- Note the percentage interest in the partnership after the transfer for accurate partnership representation.

- If applicable, list any depreciation recapture recognized by the partnership and how it will be allocated to partners.

- In Part II, provide any supplemental information required based on the instructions for clarity on the property type.

- In Part III, report any dispositions that occurred after the initial transfer. This includes the date of original transfer, the date of disposition, and manner of disposition.

- Finally, indicate if any transfer reported is subject to gain recognition under specified sections.

- After filling out all required fields, users can save the changes made to the document, download a copy, or share it as needed.

Complete your documents online today for a smooth filing experience.

Schedule K-1 is an Internal Revenue Service (IRS) tax form issued annually for an investment in a partnership. The purpose of the Schedule K-1 is to report each partner's share of the partnership's earnings, losses, deductions, and credits. Schedule K-1 serves a similar purpose as Form 1099.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.