Loading

Get Form 8849 (schedule 3) (rev. January 2002). Gasohol Blending

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8849 (Schedule 3) (Rev. January 2002). Gasohol Blending online

This guide provides a clear and supportive overview for users looking to complete Form 8849 (Schedule 3) (Rev. January 2002) for gasohol blending online. Follow these step-by-step instructions to ensure that your claims are accurate and complete.

Follow the steps to successfully complete your gasohol blending claim

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Enter your name as it appears on Form 8849 in the designated field. This identifies you as the claimant.

- Provide your Employer Identification Number (EIN) or Social Security Number (SSN) in the appropriate section for verification purposes.

- In the ‘Total refund’ box, add all amounts from column (c) for each applicable gasohol type. Ensure that calculations are accurate.

- Certify your claim by confirming that you purchased gasoline taxed at the full rate and blended it with alcohol to produce gasohol, which was sold or used in your business.

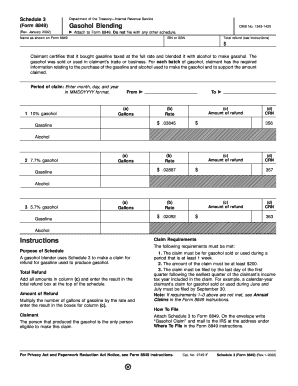

- In the ‘Period of claim’ section, enter the starting and ending dates of the gasohol sales in the MMDDYYYY format.

- For each type of gasohol mentioned (10%, 7.7%, and 5.7%), fill in the total gallons used, the set rate for refund, and calculate the amount of refund in column (c).

- Ensure all related information, including the CRN for both gasoline and alcohol, is included. It helps support the amount claimed.

- Review your completed form for accuracy. Once satisfied, save your changes, and options to download, print, or share the completed form will be available.

Start completing your Form 8849 (Schedule 3) for gasohol blending online today.

Form 8849 - Claim for Refund of Excise Taxes Generally you can claim for Refund of Excise Taxes using the Form 8849 and using the appropriate schedules as below: Schedule 1: Nontaxable Use of Fuels. Schedule 2: Sales by Registered Ultimate Vendors. Schedule 3: Certain Fuel Mixtures and the Alternative Fuel Credit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.