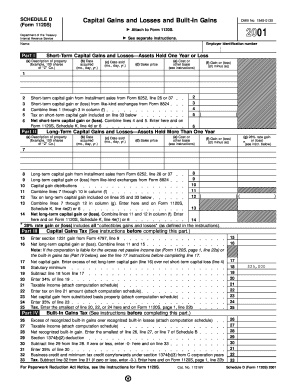

Get 2001 Form 1120s (schedule D). Capital Gains And Losses And Built-in Gains

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign a form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:Finding a legal specialist, creating an appointment and coming to the workplace for a private meeting makes doing a 2001 Form 1120S (Schedule D). Capital Gains And Losses And Built-in Gains from start to finish exhausting. US Legal Forms lets you rapidly produce legally valid documents according to pre-created web-based samples.

Prepare your docs in minutes using our straightforward step-by-step guideline:

- Find the 2001 Form 1120S (Schedule D). Capital Gains And Losses And Built-in Gains you need.

- Open it with cloud-based editor and start altering.

- Complete the blank fields; engaged parties names, places of residence and numbers etc.

- Customize the template with unique fillable fields.

- Include the particular date and place your e-signature.

- Click Done following double-checking all the data.

- Download the ready-created document to your gadget or print it out as a hard copy.

Quickly generate a 2001 Form 1120S (Schedule D). Capital Gains And Losses And Built-in Gains without needing to involve experts. We already have more than 3 million users making the most of our rich collection of legal forms. Join us today and get access to the #1 collection of web blanks. Try it yourself!

Capital gains and deductible capital losses are reported on Form 1040, Schedule D, Capital Gains and Losses, and then transferred to line 13 of Form 1040, U.S. Individual Income Tax Return. Capital gains and losses are classified as long-term or short term.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.