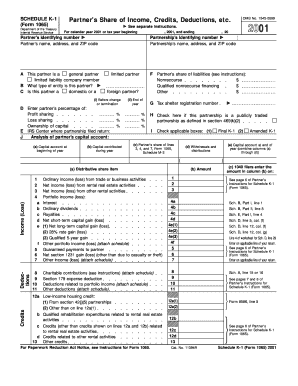

Get Schedule K-1 (form 1065) Department Of The Treasury Internal Revenue Service Partner's Share Of

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign a form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:Are you still seeking a quick and convenient tool to complete SCHEDULE K-1 (Form 1065) Department Of The Treasury Internal Revenue Service Partner's Share Of at an affordable price? Our platform offers you an extensive library of templates that are available for submitting on the internet. It only takes a couple of minutes.

Follow these simple steps to get SCHEDULE K-1 (Form 1065) Department Of The Treasury Internal Revenue Service Partner's Share Of completely ready for submitting:

- Choose the form you require in the collection of legal templates.

- Open the document in the online editing tool.

- Read through the instructions to learn which info you have to provide.

- Click the fillable fields and put the required data.

- Put the relevant date and insert your e-signature after you fill in all of the boxes.

- Examine the completed document for misprints as well as other mistakes. If you necessity to change something, our online editor and its wide range of instruments are available for you.

- Download the new template to your device by clicking Done.

- Send the e-form to the parties involved.

Submitting SCHEDULE K-1 (Form 1065) Department Of The Treasury Internal Revenue Service Partner's Share Of doesn?t really have to be confusing any longer. From now on simply get through it from home or at your business office straight from your smartphone or personal computer.

Purpose of Schedule K-1 The partnership uses Schedule K-1 to report your share of the partnership's income, deductions, credits, etc. Keep it for your records. Don't file it with your tax return unless you are specifically required to do so. 2022 Partner's Instructions for Schedule K-1 (Form 1065) - IRS IRS (.gov) https://.irs.gov › pub › irs-pdf › i1065sk1 IRS (.gov) https://.irs.gov › pub › irs-pdf › i1065sk1 PDF

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.