Loading

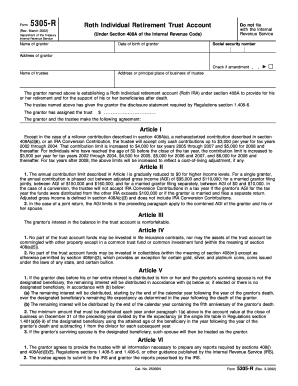

Get The Grantor Named Above Is Establishing A Roth Individual Retirement Account (roth Ira) Under

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out The Grantor Named Above Is Establishing A Roth Individual Retirement Account (Roth IRA) Under online

Filling out The Grantor Named Above Is Establishing A Roth Individual Retirement Account (Roth IRA) Under can seem daunting, but this guide simplifies the process for you. By following these steps, you will be able to provide the necessary information accurately and efficiently online.

Follow the steps to complete your Roth IRA form.

- Click ‘Get Form’ button to obtain the form and open it in the required program.

- Enter the name of the grantor in the designated field. This is the individual establishing the Roth IRA and should be their full legal name.

- Fill in the grantor's date of birth. Ensure that the format is correct according to the specifications laid out in the form.

- Input the grantor's social security number accurately, as this is crucial for tax purposes.

- Provide the grantor's address. Make sure to include all relevant details such as street address, city, state, and ZIP code.

- If applicable, check the box indicating this is an amendment.

- Enter the name of the trustee. The trustee manages the account and must be an IRS-approved entity or individual.

- Provide the trustee's address or principal place of business. This information helps identify where the trustee can be contacted.

- Complete the assigned trust value field, indicating the monetary amount assigned by the grantor.

- Review Articles I through IX to understand the terms, limits, and agreements stated within the form. Make any necessary mentions as applicable.

- Once all fields are accurately filled, you can save your changes, download, print, or share the completed form as needed.

Start your Roth IRA process by filling out the form online today.

A Roth IRA can be a good savings option for those who expect to be in a higher tax bracket in the future, making tax-free withdrawals even more advantageous.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.