Loading

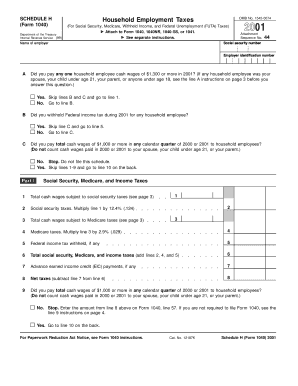

Get Schedule H (form 1040) Department Of The Treasury Internal Revenue Service (99) Household

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SCHEDULE H (Form 1040) Department of the Treasury Internal Revenue Service (99) Household online

Filling out the SCHEDULE H (Form 1040) is essential for reporting household employment taxes. This guide provides a clear, step-by-step approach to completing this form online, ensuring you understand each component and can file with confidence.

Follow the steps to complete your SCHEDULE H form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name as the employer in the designated field at the top of the form. Ensure that you provide accurate personal information.

- Provide your social security number and employer identification number by filling in the appropriate boxes.

- Answer the initial questions regarding cash wages paid to household employees. If you paid $1,300 or more, proceed to line 1. If not, follow the subsequent instructions relevant to your situation.

- Complete Part I by detailing total cash wages subject to Social Security and Medicare taxes. Follow the computation steps by multiplying as indicated.

- For federal income tax withheld, enter the amount if applicable in line 5. Otherwise, proceed to calculate total taxes.

- In line 8, subtract any advance earned income credit payments from the total taxes to find the net taxes.

- Move to Part II, answering questions about unemployment contributions. If applicable, provide the necessary details in Section A or B based on your answers.

- Finalize Part III by summing the household employment taxes. Follow the instructions carefully to ensure accurate totals.

- If required, complete Part IV by providing your address and signature at the bottom of the form. Ensure that all statements are true and correct.

- Once all sections are complete, save your changes and choose to download, print, or share the form as needed.

Start filling out your SCHEDULE H online today to ensure accurate reporting of your household employment taxes.

If you employed a person to perform work in your household and you had control over the what the person did and how they did it, then you must complete Schedule H. You must file Schedule H even if you don't file an individual income tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.