Loading

Get Mo W-4a 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO W-4A online

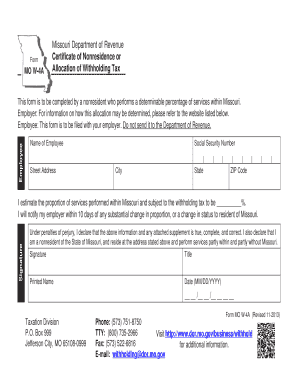

The MO W-4A form is essential for nonresidents performing services within Missouri, helping to allocate the appropriate withholding tax. This guide provides you with detailed, step-by-step instructions to complete the MO W-4A effectively.

Follow the steps to complete the MO W-4A form online.

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

- Enter your name in the 'Name of Employee' field. Ensure that the name matches the one on your official identification.

- Fill out your residential address in the 'Street Address' section, ensuring to include all relevant details for accurate identification.

- Provide your Social Security Number in the corresponding field to validate your identity.

- Complete the 'City' and 'ZIP Code' sections with the respective information related to your residential address.

- In the section for estimating the proportion of services performed within Missouri, indicate the percentage (%) of your services that are subject to withholding tax.

- Acknowledge your responsibility to notify your employer within 10 days of any significant changes in your service percentage or a change in residency status.

- Sign the document in the 'Signature' field to attest that all information provided is true, complete, and correct under penalties of perjury.

- Print your name in the 'Printed Name' section below your signature for clarity.

- Fill in the date of signing in the specified format (MM/DD/YYYY) to indicate when the form was completed.

- After completing the form, you may save changes. The completed form can then be printed, downloaded, or shared with your employer as needed.

Complete your MO W-4A form online today and ensure your compliance with Missouri tax regulations.

Related links form

For 2023, the first $1,000 of income is tax-exempt. The top tax rate is also reduced from 5.3% to 4.95% (on more than $8,968 of taxable income). (Note: Kansas City and St. Louis also impose an earnings tax.)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.