Get Al Schedule K-1 Form 41 Instructions 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL Schedule K-1 Form 41 Instructions online

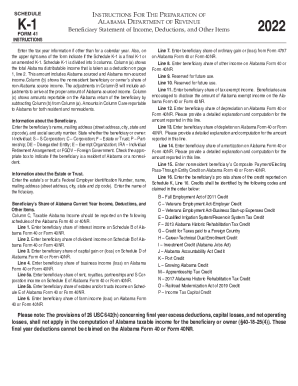

The AL Schedule K-1 Form 41 Instructions guide users on how to report income, deductions, and other items related to certain beneficiaries. This step-by-step guide is designed to assist users in accurately completing the form online.

Follow the steps to fill out the AL Schedule K-1 Form 41 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the tax year information if it differs from a calendar year. Indicate in the upper right area of the form whether the Schedule K-1 is a final or amended K-1.

- In Column (a), enter the total Alabama distributable income, which includes both Alabama sourced and non-sourced income.

- In Column (b), input the nonresident beneficiary's share of non-Alabama source income, including any necessary adjustments.

- In Column (c), calculate the amounts reportable on the Alabama return by subtracting the value from Column (b) from the total in Column (a).

- Complete the information section for the beneficiary by entering their name, mailing address, and social security number. Indicate their type (individual, corporation, etc.) and residency status.

- Fill in the information about the estate or trust, including the Federal Employer Identification Number, name, mailing address, and fiduciary name.

- Report the beneficiary's share of income, deductions, and other items in Column C, referring to the appropriate lines for various types of income on the Alabama Form 40 or 40NR.

- In the applicable lines, provide detailed explanations and computations for amounts such as depreciation, depletion, and amortization.

- Lastly, review all entries for accuracy, then save your changes, download, print, or share the completed form as needed.

Complete your documents online for accurate and efficient filing.

Get form

Do not attach a federal return unless the client is filing Form 540 with any federal schedules other than Schedule A or Schedule B, Long or Short Form 540NR, or a return for an RDP couple. Note: For e-file, your software should transmit the federal return, when it is required, with the state return. CHECKLIST FOR A TROUBLE-FREE TAX RETURN - Spidell caltax.com https://.caltax.com › spidellweb › public › editorial caltax.com https://.caltax.com › spidellweb › public › editorial

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.