Loading

Get Ga G2-rp 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA G2-RP online

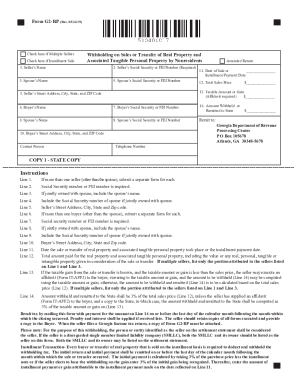

Filling out the GA G2-RP form accurately is essential for reporting the withholding on sales or transfer of real property by nonresidents. This guide provides a clear step-by-step process to assist you in completing the form online with confidence.

Follow the steps to fill out the GA G2-RP form online.

- Press the ‘Get Form’ button to access the GA G2-RP form and open it for online completion.

- Enter the seller's name in the designated field. If there are multiple sellers, ensure to check the box indicating this.

- Input the seller's Social Security number or Federal Employer Identification number, as this information is mandatory.

- Provide the spouse's name if the property is jointly owned, and include the spouse's Social Security number if applicable.

- Fill in the seller's street address, city, state, and ZIP code.

- If there is a buyer, enter their name and ensure to check if there are multiple buyers.

- Input the buyer's Social Security number or Federal Employer Identification number, which is also required.

- If jointly owned, include the spouse's name of the buyer and their Social Security number if needed.

- Provide the buyer's street address, city, state, and ZIP code.

- Enter the date of sale or installment payment date in the specified field.

- List the total sales price of the property, ensuring to reflect the correct amount.

- Indicate the taxable amount or gain if known, and be reminded that an affidavit may be required.

- Calculate the amount to be withheld or remitted to the state, based on the total sales price or taxable amount.

- Review all entered information for accuracy, then save your changes, download a copy, or prepare to print the form.

Complete your GA G2-RP form online to ensure timely processing.

Related links form

The amount of tax withheld from your pay depends on what you earn each pay period. It also depends on what information you gave your employer on Form W-4 when you started working. This information, like your filing status, can affect the tax rate used to calculate your withholding.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.