Loading

Get Ga St-12b 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA ST-12B online

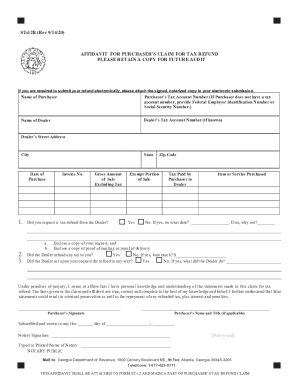

The GA ST-12B form is an affidavit for a purchaser's claim for a tax refund. This guide provides clear instructions on how to complete the form online, ensuring a smooth and accurate filing process for users.

Follow the steps to accurately complete the GA ST-12B form online

- Press the ‘Get Form’ button to obtain the GA ST-12B form and open it in the digital editor.

- Begin by entering your name in the designated field labeled 'Name of Purchaser'. This is the individual or entity filing the refund claim.

- Next, provide your Tax Account Number. If you do not have a tax account number, include your Federal Employer Identification Number or Social Security Number in the appropriate field.

- Fill in the 'Name of Dealer', entering the dealer from whom the purchase was made.

- If known, include the 'Dealer’s Tax Account Number'. This helps in identifying the dealer's account.

- Enter the complete street address of the dealer, followed by the city, state, and zip code.

- Specify the date of purchase by selecting or entering the appropriate date.

- Input the invoice number associated with your purchase in the 'Invoice No.' section.

- Document the gross amount of the sale excluding tax in the designated field.

- Indicate whether you requested a tax refund from the dealer by selecting 'Yes' or 'No'. If 'Yes', provide the date you made the request and if 'No', explain the reason.

- Inquire if the dealer refunded any tax to you. Select 'Yes' or 'No', and if 'Yes', specify the amount refunded.

- State if the dealer acted upon your refund request in any way. Again, select 'Yes' or 'No', and if 'Yes', describe the action taken by the dealer.

- Complete the affirmation statement by signing and dating where indicated. Ensure you provide your name and title if applicable.

- Submit the form to your notary public for signature and seal in the specified section.

- Once completed, save your changes, download a copy, print it, or share it as needed.

Complete your GA ST-12B form online today for a hassle-free tax refund experience.

Related links form

Once the DOR files a tax lien, they have ten years from that date to collect the unpaid taxes. The 10-year time clock may be tolled (paused) under certain circumstances. For example, when the taxpayer is in a Payment Agreement with the DOR or when the taxpayer has filed bankruptcy. Georgia State Tax Resolution Options for Taxes Owed - TaxCure taxcure.com https://taxcure.com › state-taxes › georgia taxcure.com https://taxcure.com › state-taxes › georgia

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.