Loading

Get Fl Orp-etf 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL ORP-ETF online

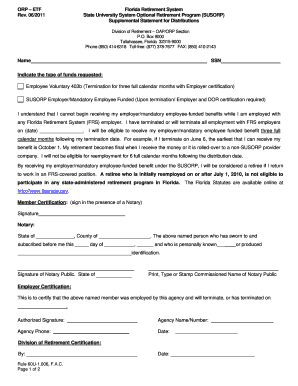

The Florida Retirement System's Optional Retirement Program (SUSORP) requires users to complete the FL ORP-ETF form for distribution requests. This guide offers a clear and structured approach to successfully fill out this form online, ensuring that you understand each component involved.

Follow the steps to effectively complete the FL ORP-ETF form online.

- Click the ‘Get Form’ button to access the FL ORP-ETF form and open it in the editor.

- Begin by entering your name and Social Security number in the designated fields provided at the top of the form.

- You will see two checkboxes indicating the type of fund requested. Choose the appropriate box based on your request: 'Employee Voluntary 403(b)' or 'SUSORP Employer/Mandatory Employee Funded.' Make sure to read the conditions that apply to each option.

- Next, indicate your termination date. This is crucial as it influences your eligibility to receive funds. Ensure that the date you provide is accurate.

- Complete the Member Certification section. You must sign this section in the presence of a notary. Ensure that all required information is accurately filled in.

- If you are requesting access to employer/mandatory employee-funded contributions, complete the additional section on the second page of the form that contains important information about these contributions.

- Once you have completed all sections, review the entire form for completeness and accuracy to avoid any processing delays.

- Finally, save your changes. You may then download, print, or share the completed form as needed.

Begin your online process by completing the FL ORP-ETF form.

Related links form

No, an ORP and a 403B plan differ significantly in their design and offered benefits. An ORP is typically available to certain Florida state employees, while a 403B plan is primarily for employees of non-profit organizations and educational institutions. Both plans provide valuable retirement savings opportunities but cater to different audiences and regulatory frameworks.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.