Loading

Get Sc D-137 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC D-137 online

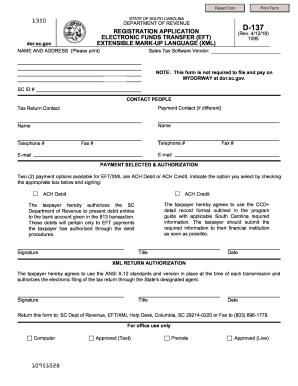

The SC D-137 is a registration application for electronic funds transfer that allows users to manage their sales tax submissions effectively. This guide will provide a clear overview and step-by-step instructions to help you complete the form online with ease.

Follow the steps to fill out the SC D-137 form accurately.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- In the 'Name and Address' section, clearly print your mailing address for correspondence related to EFT/XML.

- For the 'Sales Tax Software Vendor' field, specify the software you will be using to file your sales tax return.

- Enter your SC ID# (Single Identification Number), which can be found on your Retail License. Use only the first seven digits.

- Designate a 'Tax Return Contact' person, the individual responsible for filing the XML return, and provide their contact details.

- If applicable, indicate a different person as the 'Payment Contact' responsible for making the EFT payment and include their information.

- Select your payment method by checking either the ACH Debit or ACH Credit box. Ensure you understand the requirements for the selected option.

- For ACH Debit, an authorized person must sign and date the form. For ACH Credit, confirm your bank supports this method before signing.

- In the XML Return Authorization section, the taxpayer must agree to the ANSI X.12 standards and provide necessary signatures.

- Review all information for accuracy, save your changes, and proceed to download, print, or share the completed form as needed.

Complete your SC D-137 registration application online today.

Related links form

South Carolina Tax Extension Form: To request a South Carolina extension, file Form SC4868 by the original due date of your return. Make sure to attach a copy of your extension to your South Carolina tax return when you file.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.