Loading

Get Al Schedule K-1 Form 41 Instructions 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL Schedule K-1 Form 41 Instructions online

Filling out the AL Schedule K-1 Form 41 can initially seem daunting, but with clear guidance, it can be a straightforward process. This guide provides step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete the AL Schedule K-1 Form 41 online.

- Click ‘Get Form’ button to obtain the form and open it in your chosen online editor.

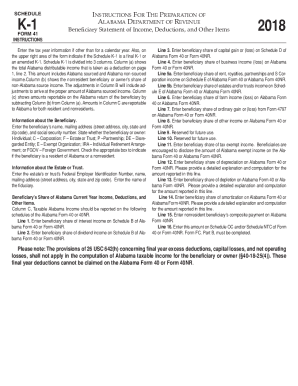

- Enter the tax year information in the designated area if it differs from a calendar year. In the upper right portion of the form, indicate whether the Schedule K-1 is a final K-1 or an amended K-1.

- Locate the three columns of the form. In Column (a), input the total Alabama distributable income, which includes both Alabama sourced and non-sourced income. This amount is taken as a deduction on page 1, line 2.

- Fill out Column (b) with the nonresident beneficiary or owner’s share of non-Alabama sourced income. Make necessary adjustments in this column to ensure accuracy.

- In Column (c), calculate and report the amounts by subtracting Column (b) from Column (a). These amounts are reportable to Alabama for both resident and nonresident beneficiaries.

- Provide the beneficiary's details, including their name, mailing address, and social security number. Specify their classification by checking the appropriate box (e.g., Individual, Corporation, Estate or Trust).

- Enter the estate’s or trust’s Federal Employer Identification Number, name, and mailing address, along with the name of the fiduciary.

- Report the beneficiary’s share of Alabama current year income and deductions, referring to the specific lines relating to interest, dividends, capital gains, business income, and other categories as outlined in the instructions.

- Ensure to complete the lines for tax-exempt income, depreciation, depletion, and amortization as applicable, providing detailed explanations and computations when required.

- Once all information is correctly filled out and double-checked for accuracy, save your changes. You can then choose to download, print, or share the completed form as needed.

Start completing your AL Schedule K-1 Form 41 online today to ensure timely filing and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Generally, you must file an income tax return if you're a resident , part-year resident, or nonresident and: Are required to file a federal return. Receive income from a source in California.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.