Loading

Get Az Form 352 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ Form 352 online

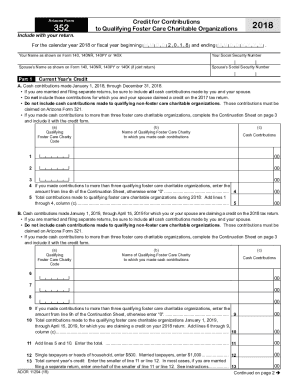

AZ Form 352 is used to claim a credit for contributions made to qualifying foster care charitable organizations. This guide will provide clear steps to help you fill out the form online efficiently and accurately, ensuring you do not miss any important details.

Follow the steps to fill out the AZ Form 352 online:

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Begin with Part 1, Current Year’s Credit. Enter cash contributions made from January 1, 2018, through December 31, 2018, including contributions from both you and your spouse if filing separately. Ensure you do not include contributions claimed on the previous year's tax return.

- In section A, list cash contributions to qualifying foster care charities by providing the charity code, name, and the amount contributed in the designated fields.

- If applicable, complete the Continuation Sheet located on page 3 for contributions made to more than three foster care charities and include the total amount on line 4 of Part 1.

- Move to section B, and enter contributions made from January 1, 2019, through April 15, 2019, again ensuring to include both yours and your spouse's contributions if married filing separately.

- Complete the same process as in step 3 for section B, ensuring to maintain the same format for entries.

- Calculate total contributions made to the qualifying foster care charitable organizations for both periods by adding totals from section A and section B. Record this total on line 11.

- Complete line 12 based on your filing status: enter $500 for single or head of household, or $1,000 for married filing jointly.

- Determine your total current year’s credit by entering the smaller amount of line 11 or line 12 on line 13, keeping in mind special instructions if married filing separately.

- Proceed to Part 2 for Available Credit Carryover if applicable; list previous years’ credits and calculate the total available carryover.

- In Part 3, record the current year’s credit from Part 1, line 13 on line 20 and the available carryover amount on line 21.

- Finally, calculate the Total Available Credit by adding line 20 and line 21, then enter this on the specified line.

- After completing all sections, ensure to save your changes and use the options to download, print, or share the completed form.

Complete your documents online today.

Related links form

Taxpayers meeting the qualifications in the chart below may receive an Arizona income or premium tax credit valued at up to $9,000 per each new quality job. Tax credits may be claimed in annual increments of $3,000 each over a period of up to three taxable years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.