Loading

Get For Calendar Year 20 Omb No

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the For Calendar Year 20 OMB No online

This guide provides step-by-step instructions for completing the For Calendar Year 20 OMB No form online. It aims to support users through the filling process, ensuring accuracy and compliance with necessary guidelines.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to obtain the complete form and open it in your preferred editor.

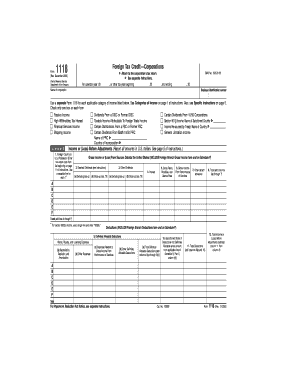

- Fill out the required basic information at the top of the form, including the name of the corporation, employer identification number, tax year beginning and ending dates.

- Carefully input your gross income or loss from foreign sources. Ensure you follow the specific categorization per country, entering the two-letter code where indicated.

- Report any deemed dividends and other types of dividends in the respective lines, ensuring to follow the form instructions for accurate total calculations.

- Complete the deductions section by detailing allocable deductions, including categories like depreciation and other expenses related to gross income from services.

- Compute the total deductions and the total income or loss before adjustments by following the mathematical guidance provided in the form.

- Fill out the separate schedules as required, ensuring you complete Parts I, II, and III, accurately reflecting taxes deemed paid and foreign tax credits.

- Review all entered information for accuracy. Save your changes, then download or print the completed form for submission.

Complete the form online today to ensure your filings are accurate and timely.

Your tax return covers the income year from 1 July to 30 June. If you need to complete a tax return you must lodge it or engage with a tax agent, by 31 October.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.