Loading

Get 2004 Form 8835 (rev. December 2005) - Internal Revenue Service

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2004 Form 8835 (Rev. December 2005) - Internal Revenue Service online

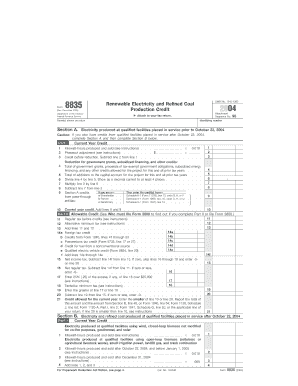

Filling out the 2004 Form 8835 is essential for individuals and businesses seeking to claim the renewable electricity and refined coal production credit. This guide provides step-by-step instructions for completing the form online, tailored to assist users with varying levels of experience.

Follow the steps to fill out the form correctly and efficiently.

- Press the 'Get Form' button to acquire the form and open it in your preferred digital platform.

- Enter the name(s) shown on your return and your identifying number at the top of the form. Ensure that these details match the records you have on file with the IRS.

- Proceed to Section A. Here, enter the kilowatt-hours produced and sold in line 1, then multiply the result by 0.018. Make sure to keep accurate figures for this calculation.

- Continue with lines 2 through 10 in Section A, filling out the phaseout adjustment as directed in the instructions. Pay close attention to any adjustments based on government grants or subsidized financing.

- If necessary, complete Section B for credits related to electricity and refined coal produced after October 22, 2004. Follow the form prompts for lines 1 through 10, making appropriate calculations and adjustments based on your production data.

- Review Part II for the allowable credit. Calculate the credits from your regular tax and alternative minimum tax according to the guidelines provided in the instructions. This section is crucial for determining the total credit you can claim.

- After entering all required information and calculations, save your changes. You can then download, print, or share the completed form as appropriate.

Complete your documents online today to ensure accurate and timely filing.

If you're one of those who asks how does IRS verify solar credit, you can claim the solar tax credit on IRS Form 5695 under the residential energy credit, and it applies to both homes being built and existing residences.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.