Loading

Get Atd_monthly_report_of_cigarettes_with_other_states_tax_stamps_affixed_att142sum. Image

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ATD_MONTHLY_REPORT_OF_CIGARETTES_WITH_OTHER_STATES_TAX_STAMPS_AFFIXED_ATT142SUM. Image online

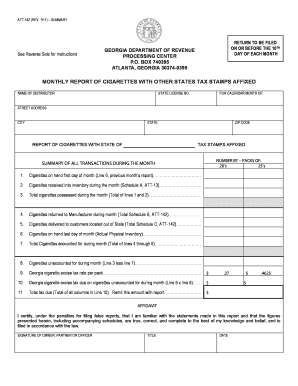

The ATD_MONTHLY_REPORT_OF_CIGARETTES_WITH_OTHER_STATES_TAX_STAMPS_AFFIXED_ATT142SUM. Image is a crucial document for distributors of cigarettes in Georgia. This guide will walk you through each section of the form to ensure accurate completion and timely submission.

Follow the steps to effectively complete the form.

- Use the ‘Get Form’ button to obtain the form, which will allow you to access it in an online editor.

- Begin by entering the name of your distribution entity in the designated field at the top of the form.

- Input your state license number in the corresponding section. This number is essential for identification.

- Specify the calendar month for which the report is being filed in the provided field.

- Fill out the street address, city, state, and ZIP code for your business location in the appropriate fields.

- Document the number of cigarettes on hand at the beginning of the month in line 1, based on your previous month’s report.

- Enter the number of cigarettes received into inventory during the month from Schedule A, ATT-13 in line 2.

- Calculate the total number of cigarettes possessed during the month by adding the values from lines 1 and 2 together for line 3.

- Record the number of cigarettes returned to the manufacturer during the month in line 4, referencing Schedule B, ATT-142.

- Indicate the number of cigarettes delivered to customers located out of state in line 5, supported by Schedule C, ATT-142.

- In line 6, report the actual physical inventory of cigarettes on hand at the end of the month.

- Sum lines 4 through 6 to calculate the total cigarettes accounted for during the month, entering this in line 7.

- If applicable, enter the number of unaccounted cigarettes in line 8 by subtracting line 7 from line 3, leaving it blank if it’s not applicable.

- Review the preprinted Georgia cigarette excise tax rate per pack in line 9 and ensure its accuracy.

- Calculate the tax due for unaccounted cigarettes in line 10 by multiplying the number of unaccounted packs (line 8) by the tax rate (line 9).

- Total all columns in line 10 to determine the total tax due for line 11, ensuring this amount is prepared for submission.

- Complete the affidavit section by signing, indicating your position, and dating the report to certify its accuracy.

- After final review, save your changes, and choose to download, print, or share the report as needed.

Complete your forms online today to ensure compliance and timely reporting.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.