Loading

Get Nj Gross Income Tax Depreciation Adjustment Worksheet Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nj Gross Income Tax Depreciation Adjustment Worksheet Form online

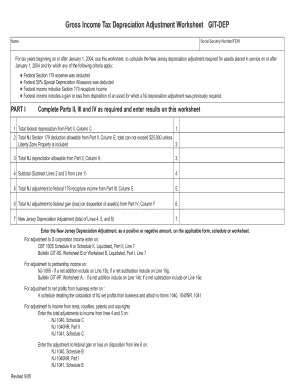

Filling out the Nj Gross Income Tax Depreciation Adjustment Worksheet Form GIT-DEP can help you accurately calculate your New Jersey depreciation adjustments for tax purposes. This guide provides clear, step-by-step instructions on each section of the form, ensuring you complete it correctly online.

Follow the steps to complete your worksheet accurately.

- Click ‘Get Form’ button to access the Nj Gross Income Tax Depreciation Adjustment Worksheet Form and open it in your editing tool.

- Enter your name and Social Security Number or FEIN at the top of the form. This information is essential for your identification and processing.

- Review Part I, which requires you to identify if your assets fall under the required criteria such as having deducted Section 179 expense or federal 50% special depreciation.

- For each asset listed in Part II, input the description, date placed in service, and any federal depreciation or Section 179 deduction amounts applicable. Ensure accurate data entry to reflect your property accurately.

- Calculate your New Jersey Section 179 deduction allowable in Column E of Part II, ensuring it does not exceed $25,000 unless you include Liberty Zone Property.

- In Part III, calculate the New Jersey adjustment to federal 179 recapture income by detailing each asset’s information, including their recapture income.

- Proceed to Part IV to compute the adjustment to federal gain or loss on the disposition of the asset. List each asset accordingly and ensure the calculations reflect the New Jersey adjustments.

- After completing all parts, total the adjustments on Part I lines as required and input these totals in the appropriate forms or schedules.

- Once completed, save your changes, and you can download, print, or share the form as needed.

Start filling out your Nj Gross Income Tax Depreciation Adjustment Worksheet Form online today for accurate tax reporting.

If asset is put to use for less than 180 days then amount equal to 50% of the amount calculated using normal depreciating rates is allowed as depreciation. i.e Asset put to use on or before 3rd oct of the year (4th oct in case of leap year) then 100% depreciation is allowed, otherwise 50%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.