Loading

Get 5.6 Entry Relieving Estate From Administration.doc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 5.6 Entry Relieving Estate From Administration.doc online

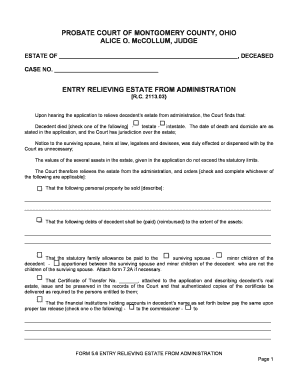

Filling out the 5.6 Entry Relieving Estate From Administration form is an important step in managing an estate without formal probate. This guide offers clear, step-by-step instructions to help you complete the form online with confidence and ease.

Follow the steps to successfully fill out your form online.

- Click the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Begin by locating the section for the decedent's name, which should be the name of the deceased person. Fill in the blank with the full legal name.

- Next, enter the case number in the appropriate field. This number is essential for identifying the estate in court records.

- Indicate whether the decedent died testate (with a will) or intestate (without a will) by checking the correct box provided.

- Fill in the date of death and the domicile of the decedent as stated in the application. This information confirms the court's jurisdiction.

- Acknowledge whether notice to the surviving spouse, heirs at law, legatees, and devisees was given or deemed unnecessary, by selecting the correct option.

- Provide details concerning the values of the various assets in the estate to confirm they do not exceed the statutory limits.

- In the designated area, describe any personal property that is to be sold. Be specific about the items listed.

- List any debts of the decedent that will be paid from the estate assets, ensuring to state how the debts will be addressed.

- Select and complete the appropriate options regarding the distribution of the statutory family allowance to the surviving spouse and minor children.

- Complete the section regarding the certificate of transfer, noting the description and relevance to the decedent's real estate.

- Identify the financial institutions holding accounts in the decedent's name, detailing the payment instructions.

- Fill in the section for the distribution of the remainder of the estate, including names of distributees, properties, and their respective values.

- Appoint a commissioner by providing their name, who will be responsible for receiving, selling, or distributing the personal property.

- Finally, ensure the date is filled out and sign with the judge's information as necessary. Review all details before final submission.

Complete your estate documents online today for a seamless process.

To obtain your Ohio Certificate of Authority, you will submit an Application for Certificate of Authority, along with required certificates or certified copies from your home state. You will need to appoint a registered agent in order for your filing to be approved.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.