Loading

Get Employees That Have Been Offered Relocation Expense Reimbursement As Part Of Their Employment With

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Employees That Have Been Offered Relocation Expense Reimbursement As Part Of Their Employment With online

This guide provides a clear and comprehensive overview for employees preparing to fill out the Employees That Have Been Offered Relocation Expense Reimbursement form. By following the steps outlined below, you will ensure the accurate completion of your reimbursement request.

Follow the steps to successfully complete your relocation reimbursement form.

- Click ‘Get Form’ button to access the relocation expense reimbursement form and open it in the designated editor.

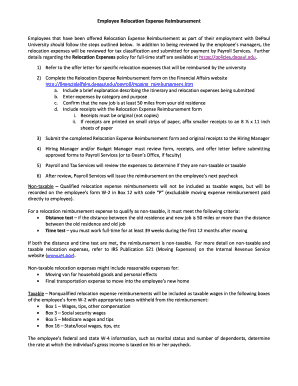

- Refer to your offer letter for specific relocation expenses that will be reimbursed by the university.

- Complete the Relocation Expense Reimbursement form, ensuring to provide a brief explanation of your itinerary and the expenses you are submitting.

- Enter your expenses categorized by type and purpose, including all relevant details.

- Confirm that your new job location is at least 50 miles away from your previous residence.

- Attach original receipts to the Relocation Expense Reimbursement form. If some receipts are printed on small strips, affix those to a standard 8 ½ x 11 inch sheet of paper.

- Submit the completed form and original receipts to your Hiring Manager for review.

- The Hiring Manager and/or Budget Manager will review your submitted form, receipts, and your offer letter before forwarding the approved documentation to Payroll Services or the Dean’s Office for faculty.

- Payroll and Tax Services will evaluate the expenses to determine their tax classification, deciding if they are taxable or non-taxable.

- Upon completion of the review by Payroll Services, expect to receive your reimbursement in your next paycheck.

Complete your relocation expense reimbursement form online today to ensure timely processing.

For most taxpayers, moving expenses are no longer deductible, meaning you can no longer claim this deduction on your federal return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.