Get Principal Trust Company Tr 533 2007-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Principal Trust Company TR 533 online

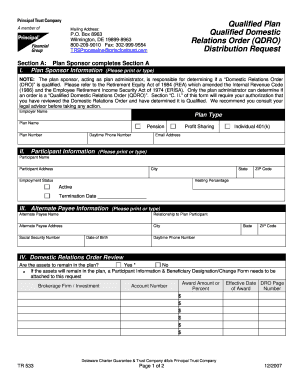

Filling out the Principal Trust Company TR 533 online is essential for requesting a distribution through a Qualified Domestic Relations Order. This guide provides a clear, step-by-step approach to complete the form accurately, ensuring that all necessary information is provided.

Follow the steps to successfully complete the Principal Trust Company TR 533 online.

- Click ‘Get Form’ button to access the form and open it in the online editor.

- In Section A, the plan sponsor should provide their information. This includes the employer name, plan type, plan name, and plan number. Ensure that you also include the daytime phone number and email address for communication purposes.

- Next, enter the participant information, including the participant's name, address, city, state, zip code, employment status, and vesting percentage. If applicable, provide the termination date.

- For the alternate payee information in Section III, provide their name, relationship to the plan participant, address, social security number, date of birth, state, zip code, and daytime phone number.

- In the Domestic Relations Order Review section, answer whether the assets will remain in the plan by selecting 'Yes' or 'No'. If the assets are to remain, ensure to attach the necessary Participant Information & Beneficiary Designation/Change Form.

- Proceed to Section B and complete the distribution information. Specify the type and method of distribution by selecting from the listed options. Include necessary tax withholding percentages or amounts.

- Enter the payment information to direct where the check should be issued. This includes filling out the financial institution name, mailing address, account number, and contact person's name.

- In Section C, both the alternate payee and plan sponsor must provide their signatures and dates. Verify that all information is accurate before submitting.

- Finally, review all entered information. Once completed, users can save changes, download a copy, print it for records, or share the form as required.

Complete your documents online for a smooth process.

To transfer your 401k from Principal, you should begin by contacting your new retirement plan provider for their specific requirements. Typically, you will need to complete a transfer request form and provide it to Principal. This process is crucial to ensure your funds move smoothly without tax penalties. For assistance and detailed information about transferring your 401k effectively, using US Legal Forms can guide you through the requirements related to Principal Trust Company TR 533.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.