Loading

Get Irs W-4(sp) 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-4(SP) online

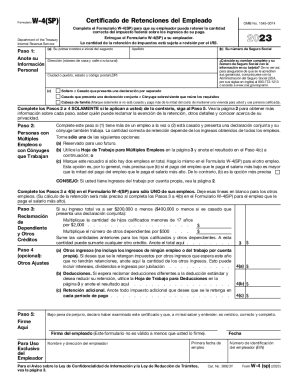

The IRS W-4(SP) form is essential for ensuring your employer withholds the correct amount of federal income tax from your pay. This guide provides clear, step-by-step instructions to help you complete the form online with confidence.

Follow the steps to fill out the IRS W-4(SP) online

- Press the ‘Get Form’ button to access the form and open it in your editing tool.

- Enter your personal information. Include your first name, middle initial, last name, and Social Security number. Ensure that your name and Social Security number match the information on your card. If they do not, contact the Social Security Administration for assistance.

- Provide your address, including house number, street, city, state, and ZIP code.

- Select your filing status by checking the box for either 'Single or Married filing separately', 'Married filing jointly or qualifying surviving spouse', or 'Head of household'.

- Proceed to steps 2 to 4 only if applicable. Skip to step 5 if not.

- If you have multiple jobs or a spouse that also works, fill out step 2 to determine the correct amount of withholding. Choose one of the options provided: either complete the Multiple Jobs Worksheet in the document or mark the appropriate box if you have only two jobs.

- In step 3, claim any dependents you will claim on your tax return. Calculate and enter the total credits for qualifying children and other dependents as specified.

- Step 4 is optional and involves making additional adjustments. Enter any other income, deductions, or additional withholding amounts you may wish to specify.

- Sign the form in step 5 to validate it. Remember, the form is not valid without your signature.

- After completing the form, you can save your changes, download a copy, print it, or share it with your employer.

Complete your IRS W-4(SP) form online today to ensure accurate tax withholding.

Related links form

1:53 5:48 Understanding the New IRS Form W-4P - YouTube YouTube Start of suggested clip End of suggested clip And step five sign and date the form frequently asked questions why did the IRS change the w4p. FormMoreAnd step five sign and date the form frequently asked questions why did the IRS change the w4p. Form the IRS redesigned the w4p form to simplify your withholding. Made tax withholding more accurate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.