Loading

Get Irs 944 (sp) 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 944 (SP) online

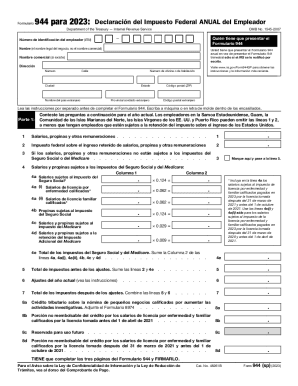

Filling out the IRS 944 (SP) form can seem daunting, but with clear guidance, you can complete it accurately and efficiently. This form is essential for employers who are required to report annual federal payroll taxes. This guide will provide a straightforward, step-by-step approach to help you navigate the process online.

Follow the steps to complete the IRS 944 (SP) form online.

- Press the ‘Get Form’ button to access the IRS 944 (SP) form and open it in your editor.

- Begin by entering your employer identification number (EIN), your business's legal name (not the trade name), and any applicable trade name and address information.

- Provide answers for the current year's questions in Part 1 concerning wages, tips, and other compensation to employees. Include details such as federal income tax withheld.

- In Part 1, list the wages and tips that are subject to Social Security and Medicare taxes. Pay careful attention to the instructions regarding qualified leave wages.

- Calculate the total taxes due before adjustments by summing the amounts on the appropriate lines.

- If applicable, enter any adjustments for the current year. This will help update your tax obligation.

- Complete the remaining fields by reporting the total taxes after adjustments and any applicable credits.

- Proceed to Part 2 and indicate your tax liability and whether the amounts are less than or greater than $2,500, and fill out the monthly obligations accordingly.

- In Part 3, answer questions about your business operations. If your business has ceased operations, indicate this and provide the last date you paid wages.

- In Part 4, specify if you wish to permit a third party to discuss your tax return with the IRS and provide their details if applicable.

- Finally, ensure you sign and date the form, attesting that the information provided is accurate, before submitting it.

- After completing all sections of the form, save your changes, and choose to download, print, or share the form as needed.

Complete your IRS 944 (SP) form online today to ensure accurate reporting of your payroll taxes.

Related links form

Form 944 reports the amount of income tax withholding and FICA tax an employer is responsible for paying. Only employers whose annual employment tax liability is less than $1,000 and have received approval from the IRS are eligible to file Form 944 (instead of Form 941)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.